Family membership

Health insurance provides insurance benefits not just to insured persons but also to their dependent family members. These family members are referred to as ";dependents";. Family members must meet certain conditions related to ";residency in Japan,"; ";the extent of the family relationship,"; and ";income"; before they are authorized as dependents.

- Dependents must be certified by the Health Insurance Society.

- If there is any change in your dependents, submit notification of the change within five days.

Family Membership

Dependent Status Eligibility Self-Assessment Chart

If you would like to add a family member as a dependent, please check this chart to see if they are eligible.

This chart is a representation of the general dependent status eligibility criteria and is not intended to be used for determining eligibility.

Is the annual income (including non-taxable income for income tax purposes) of the person you wish to register as a dependent less than 1.3 million yen (less than 1.5 million yen if age 19 or older but under 23, or less than 1.8 million yen if age 60 or older or if they are disabled to the extent that they meet the eligibility requirements for a disability welfare pension)?

*Note: For individuals age 19 or older but under 23, age requirements are determined as of December 31st of the year in question, consistent with treatment under income tax law. (Note that under civil law, age is incremented on the day before one’s birthday, so for individuals born on January 1st, their age will be incremented on December 31st.)

Since the prospective dependent may qualify as a dependent, the Health Insurance Society will evaluate their eligibility.

The Health Insurance Society will fairly and impartially evaluate whether the livelihood of the prospective dependent relies primarily on the insured person or whether the insured person is capable of continuously supporting the prospective dependent based on the submitted documents. In the absence of supporting evidence or the presence of justifiable doubt, the prospective dependent will not be granted dependent status. After granting dependent status to the dependent, the Health Insurance Society will regularly review their dependent status eligibility.

The family member in question does not qualify as a dependent.

However, exceptions are made for those who live abroad but are recognized as being based in Japan, such as students studying abroad.

The prospective dependent does not qualify as a dependent.

Caution:

- Prospective dependents are required to have a certificate of residence in Japan. (There are exceptions to the Japanese residency requirement.)

- Those who fall under the Medical Care System for the Advanced Elderly (those with a certificate of residence in Japan, either age 75 or older, or age 65 or older and recognized by a regional alliance for the medical care of the advanced elderly as being bedridden or having any other Cabinet Order-stipulated disability) cannot become dependents.

- For dependent applications where both a husband and a wife are working to support their family members, in principle, the family members shall become dependents of the husband or wife with the higher annual income from the time of application.

Notifications

Submit the documents required for the application to the Health Insurance Society via your employer (company).

The date the documents are submitted (the date they arrive at the Health Insurance Society) shall be the "date of reception."

Caution:

As a result of the examination, it has been confirmed that the applicant meets the requirements for recognition as a dependent, and only if the applicant is certified can enroll.Just because you have filed a notification does not mean you can become a dependent.

Date of dependent qualification

- If the date of reception is within one month from the date of the occurrence of the grounds and the date of the occurrence of the grounds was able to be traced back to, the date of the occurrence of the grounds shall be the "date of qualification."

- If the date of reception is more than one month from the date of the occurrence of the grounds, the date of reception shall be the "date of qualification."

- If the date of the occurrence of the grounds cannot be clearly confirmed, the date of reception shall be the "date of qualification."

Date of dependent removal

The date of loss of qualification is the date of the occurrence of the grounds for the Notification of Dependent (Change).

- Income increase: date when income exceeded the limit (monthly income is continuously 108,334 yen or more)

- Employment (enrollment in a different health insurance plan): date of employment

- Death: following day after the date of death

- Divorce: date of divorce

- Living separately (dependent no longer relies on the insured person): initial date of living separately

- Receiving employment insurance benefits: initial date of receiving benefits

- Receiving childbirth or injury and sickness allowance: initial date of receiving an allowance

- Other (eligibility criteria are no longer met): date when criteria are no longer met

Eligibility Requirements

To be deemed eligible, the following requirements must be met. Supporting documents will be requested to confirm that such requirements have been met, and a decision will be made regarding the eligibility of the prospective dependent for health insurance after a comprehensive review of the submitted documents.

- The prospective dependent is a family member within the scope of dependents stipulated in the Health Insurance Act.

- The prospective dependent has an address in Japan or is recognized as falling under exceptions to the Japanese residency requirement despite not having an address in Japan.

- The prospective dependent does not fall under the advanced elderly category.

- The prospective dependent does not fall under any exclusions from health insurance.

- The prospective dependent relies primarily on the income of the insured person for their livelihood.

- It can be confirmed that the insured person is "primarily" responsible for the prospective dependent's living expenses.

- The insured person is capable of continuously supporting the prospective dependent financially.

- If the prospective dependent has income, their income is within the specified income limit.

- Documents required by the Health Insurance Society at the time of the initial eligibility review or the annual review (continued dependent status eligibility review) are submitted on time.

- If there are any other obligors (*1), the contribution rate of the insured person to the livelihood of the prospective dependent is continuously higher than that of said obligors (*2).

- *1 Other obligors:

Children » Spouse of the insured person

Mother » Father

Younger siblings » Parents or older siblings - *2 If both a husband and a wife are working to support their children

In principle, the children shall become dependents of the parent with the higher persistent annual income, regardless of the number of children.

Note: In cases where the respective annual incomes of both a husband and a wife are nearly equal or their incomes temporarily decrease or increase, past and future income estimates shall also be taken into account.

- *1 Other obligors:

Extent of family relationship

The scope of family members eligible to be certified as dependents is legally defined. Conditions for dependent eligibility also vary depending on whether or not the family member lives with the insured person.

Family members who may live with or apart from the insured person:

- Spouse (including common law spouse)

- Children, grandchildren

- Siblings

- Parents and other lineal ascendants

Family members who must live with the insured person:

- Family members within the third degree of consanguinity other than those above

- Parents and children of the insured person's common law spouse

- Parents and children of deceased common law spouse

Scope of Family Members / Dependents

To become a dependent, certain requirements must be met. Upon becoming age 75 or older, the dependent will become an insured person under the Medical Care System for the Advanced Elderly and thus lose their qualification as a dependent.

- Persons who may or may not live together with the insured person

- Spouse

- Children (including adopted children) and grandchildren

- Siblings

- Lineal ascendants of the insured person, such as parents or grandparents

- Persons who must live together with the insured person

- Family members within three degrees of consanguinity, excluding 1 above

- Common-law spouse (listed as "Unmarried Spouse" in the certificate of residence)

- Children of a spouse who are unadopted by the insured person

- Parents and children of a common-law spouse of the insured person

- Parents and children of a deceased common-law spouse of the insured person

Income standards

To be certified as a dependent, the family member must live primarily off the insured person's income, and this is determined based on whether they live together or separately and their annual income.

Regarding the determination of annual income, an age requirement of 19-22 years old has been added, effective October 1, 2025.

Unlike specific periods like the period from January to December under the Income Tax Act or the fiscal year from April to March, annual income criteria for health insurance purposes are based on continuous 12-month periods, during which the annual income must be less than 1.3 million yen, equivalent to less than 108,334 yen on average per month (an annual income of less than 1.8 million yen, equivalent to less than 150,000 yen on average per month for those age 60 or older or those under age 60 with severe mental or physical disabilities entitling them to disability pension benefits). Also, unlike the Income Tax Act, these criteria do not differentiate between taxable and nontaxable income.

Example: For salary income, the total income amount before tax, including commuting expenses

| If the family member lives with the insured person | If the family member lives apart from the insured person |

|---|---|

| The family member's annual income must be less than 1.3 million yen (1.5 million yen if aged 19-22* [and not the insured person's spouse]; 1.8 million yen if aged 60 or above or with a disability eligible for receipt of Disability Employees' Pension benefits) and must be less than one-half the income of the insured person. | The family member's annual income must be less than 1.3 million yen (1.5 million yen if aged 19-22* [and not the insured person's spouse]; 1.8 million yen if aged 60 or above or with a disability eligible for receipt of Disability Employees' Pension benefits) and must be less than the amount of the allowance sent to the family member from the insured person. |

- * In the same way as age is defined under the Income Tax Act, whether a family member is aged 19-22 is determined based on the family member's age as of December 31 of the year. (Note that under the Civil Code, one year is added to your age on the day before your birthday, so for a family member whose birthday is January 1, the family member's age will be increased on December 31.)

| Under age 60 | Age 60 or older, or a disability pensioner |

|---|---|

| Under 1.3 million yen | Under 1.8 million yen |

| Monthly income: Under 108,334 yen | Monthly income: Under 150,000 yen |

Income

- Salary income (including part-time and side income)

Including bonuses, overtime allowances, and commuting allowances - Various pensions (National Pension, Employees' Pension, Corporate Pension, Farmers' Pension, Survivors' Pension, Disability Pension, etc.)

- Business income (income from self-employment, farming, fishing, forestry, etc.)

- Real estate income and interest

- Employment (unemployment) insurance benefits

- Injury and Sickness Allowance、Maternity Allowance

- Other persistent income

Note:

Please note that all persistent income is considered as income for health insurance purposes, even nontaxable income under the Income Tax Act.

- * You must complete procedures to remove dependents receiving employment insurance benefits as dependent family members.

- *Those receiving under 3,612 yen per day (or under 5,000 yen per day for those age 60 or older) continue to qualify as dependents.

Income from self-employment

- Income from self-employment and other sources is the amount remaining after subtracting ";directly necessary expenses"; from ";total income.";

- ";Directly necessary expenses"; refer to actual monetary expenditures, such as for raw materials, that are recognized as being essential for business operations.

- Even if the amount remaining after subtracting "directly necessary expenses" from income is less than 1.3 million yen, if you are currently employing even one person (including family members), you are not eligible as a dependent. (Those with declared salary/personnel costs are not eligible as dependents.)

Remittances due to living separately

When a family member lives separately from the insured person, the family member must receive remittances from the insured person of more than their income and the livelihood of the family member must rely primarily on said remittances for the family member to qualify as a dependent.

- * Any official documents that list the remitter, remittee, and remittance amount are acceptable as proof. Remittances made by hand are not accepted.

Government measures to address annual income barriers (starting in October 2023)

- Reference link

What are annual income barriers?

Annual income barriers refer to threshold income amounts that determine whether or not taxes and social insurance premiums are incurred.

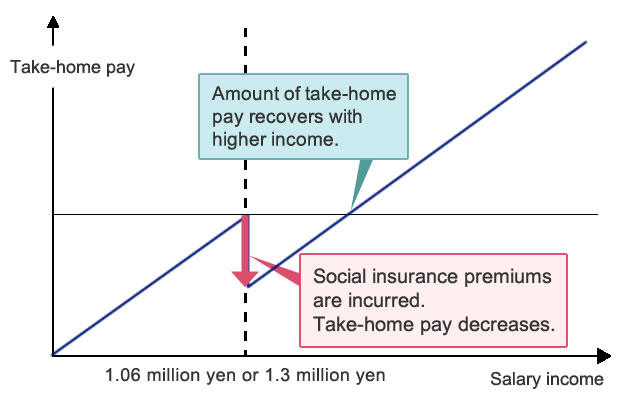

Individuals who have dependent status and work part-time or other non-regular jobs will lose their dependent status if their annual income exceeds a certain figure, and become an insured person under a company health insurance plan, National Health Insurance, or other insurance system. They will then be required to pay social insurance premiums, which may result in lower take-home pay.

One of two different annual income barriers applies for social insurance premiums, depending on company size and other factors: 1.06 million yen or 1.3 million yen.

(Source: Provisional measures to address annual income barriers (Ministry of Health, Labour and Welfare))

| 1.06 million yen annual income barrier | At companies with 51 or more employees, an employee will incur social insurance premiums if certain conditions, such as when monthly wages are 88,000 yen or more (i.e., annual income is approximately 1.06 million yen or more), are satisfied. |

|---|---|

| 1.3 million yen* annual income barrier | Social insurance premiums are incurred automatically without exception, since the worker no longer meets the dependent eligibility criteria. |

- * 1.5 million yen if aged 19-22 [and not the insured person's spouse]; 1.8 million yen if aged 60 or above or with a disability eligible for receipt of Disability Employees' Pension benefits

Handling for the 1.3 million yen annual income barrier

Although dependent certification is based on checking of taxation certificates and other documents from the previous year, if the worker’s annual income is expected to temporarily exceed 1.3 million yen due to longer hours because of labor shortage or other factors, the worker may choose to retain his or her dependent status simply by attaching a certificate from the employer.

(In principle, this handling is available no more than two consecutive times for a single worker.)

Handling for the 1.06 million yen annual income barrier

Companies that help increase worker income through means such as payment of allowances to encourage social insurance coverage* will be provided subsidies for a finite term.

* Allowances to encourage social insurance coverage

These allowances are intended to encourage employee insurance coverage for those working reduced hours and to reduce the burden of insurance premiums when workers who had been ineligible for insurance are newly covered by insurance.

Allowances to encourage social insurance coverage are to be paid apart from salaries and bonuses. They are not considered when calculating the standard monthly remuneration or standard bonuses used to determine insurance premiums.

- * Eligible persons: Those with standard monthly remuneration of 104,000 yen or less

- * Maximum allowance amount excluded from standard remuneration: Amount equivalent to the insurance premiums newly incurred by the employee due to insurance coverage

- * A time-limited measure not to exceed two years

New requirement concerning residency in Japan for dependent certification

From April 2020, a requirement related to residency in Japan is added to the requirements for certification of health insurance dependents. In principle, from April 1, 2020, those who do not have addresses in Japan cannot be certified as dependents (with certain exceptions - for example, students studying abroad).

Rationale underlying the domestic residency requirement

Determinations of residency are based on whether a person is registered to the basic resident register (i.e., whether or not the person has a certificate of residence). In principle, those who have certificates of residence in Japan meet the domestic residency requirement.

- Note: Even those who have certificates of residence in Japan will not satisfy the domestic residency requirement if they clearly do not reside in Japan - for example, those employed overseas.

Exceptions to the domestic residency requirement

Those whose livelihoods are recognized to be based in Japan, such as students studying abroad temporarily, are considered to meet the domestic residency requirement on an exceptional basis, even if they actually reside overseas.

[Cases qualifying as exceptions to the domestic residency requirement]

- (1) Students studying abroad

- (2) Family members accompanying an insured person posted abroad

- (3) Those traveling abroad temporarily for sightseeing, recreation, volunteer activities, or other reasons unrelated to employment

- (4) Those who enter into a family relationship to an insured person while the insured person is posted abroad

- (5) In addition to those described under (1)-(4) above, others whose livelihoods are recognized to be based in Japan in consideration of purposes of traveling abroad and other circumstances

Cases in which a person cannot be certified as a dependent even if he or she resides in Japan

Those who come to Japan on medical visas or on long-stay visas for sightseeing or recreational purposes cannot be certified as dependents, even if they reside in Japan.

Interim measure

As an interim measure, if a person who would lose his or her eligibility as a dependent due to the addition of the domestic residency requirement is hospitalized in a medical care institution in Japan as of the date of enactment of the requirement (April 1, 2020), his or her eligibility will continue during the period of hospitalization.

Dependent certification in cases of joint spousal support (when both spouses work)

In cases of joint spousal support (when both spouses work), the following criteria apply for determining which spouse's dependents the family members will be:

- Regardless of the number of dependent family members, they will be certified as dependents of the insured person with the higher annual income (hereinafter, "annual income" refers to projected income over the coming one-year period, based on past, current, and future earnings).

- If the difference in annual income between both spouses is no more than 10%, then the family members will be certified as dependents of the one of which the Society has been notified as the primary provider.

- If one of the spouses is an insured person under National Health Insurance, then the family members will be certified as dependents of the one with the higher income when comparing the annual income of the insured person under the Health Insurance Society and the projected annual income based on the most recent annual earnings of the insured person under National Health Insurance.

- If one spouse's health insurer does not certify the family members as dependents, a notice of such decision will be issued by the health insurer. The insured spouse of the other health insurer must then attach this notice when applying for dependent certification to the other health insurer.

- When removing the family members as dependents due to a reversal in annual income between the spouses, the deletion must be done only after first confirming that the health insurer of the insured spouse with the higher annual income will certify the family members as dependents.

- If the primary provider takes childcare leave or other leave, the dependent family members will remain dependents during the leave period, as a special measure to ensure the stability of dependent status. (Procedures for dependent certification must be conducted anew for a newborn child.)

If there has been a change in dependents

You must take specific steps if the number of dependents increases due to marriage or childbirth or a family member is no longer eligible as a dependent for reasons such as employment, living apart from the insured person, or death. The Health Insurance Society checks the eligibility status of dependents annually.